Spearpoint Capital

Private equity professional with over 8 years of experience and a track record of managing over €1.4 billion in closed real estate transactions across Europe. Spearpoint Capital advises HNWIs and SMEs on strategic capital deployment in sustainable real estate.

Our Focus: Value Creation in European Real Estate

Spearpoint Capital bridges the gap between private capital and institutional-grade real estate opportunities. For our clients, High-Net-Worth Individuals and SMEs, we leverage a deep private equity network to source and execute on value-add and opportunistic strategies across Pan-European markets. Our focus is on repositioning assets, enhancing ESG credentials, and driving returns through the analytical rigor and active management of an institutional platform.

Proven Track Record & Expertise

Track-Record

Volume: €1.4+ Billion

Strategies: Value-Add, Opportunistic, Develop-to-Trade

Experience: 8+ Years

Core Competencies

• Full-Cycle Deal Execution

• Financial Modeling & Underwriting

• Asset Management & Repositioning

• Debt & Equity Structuring

• Pan-European Market Analysis

Geographic Focus

• France

• United Kingdom

• Germany

• Netherlands

• Italy & Southern Europe

Features Transactions

Colombo Apex | Lisbon, Portugal

Grade-A Office Development (JV)

The Opportunity

A landmark 35,000 sqm Grade-A office development, representing the third and final phase of the iconic 173,000 sqm Centro Colombo mixed-use complex. Sourced to capitalize on the structurally under-supplied market for modern office space in Lisbon, the project is designed to the highest ESG standards, targeting both LEED and WELL Platinum certifications.

My Role

As a key member of the deal team, I was responsible for the full-cycle execution of this transaction. I co-led the underwriting process, building the financial models that were foundational to our investment thesis. A critical part of my contribution involved structuring the joint venture with our local partner, Sonae Sierra, and managing the due diligence workstreams that enabled us to secure the deal and present a robust case to the Investment Committee.

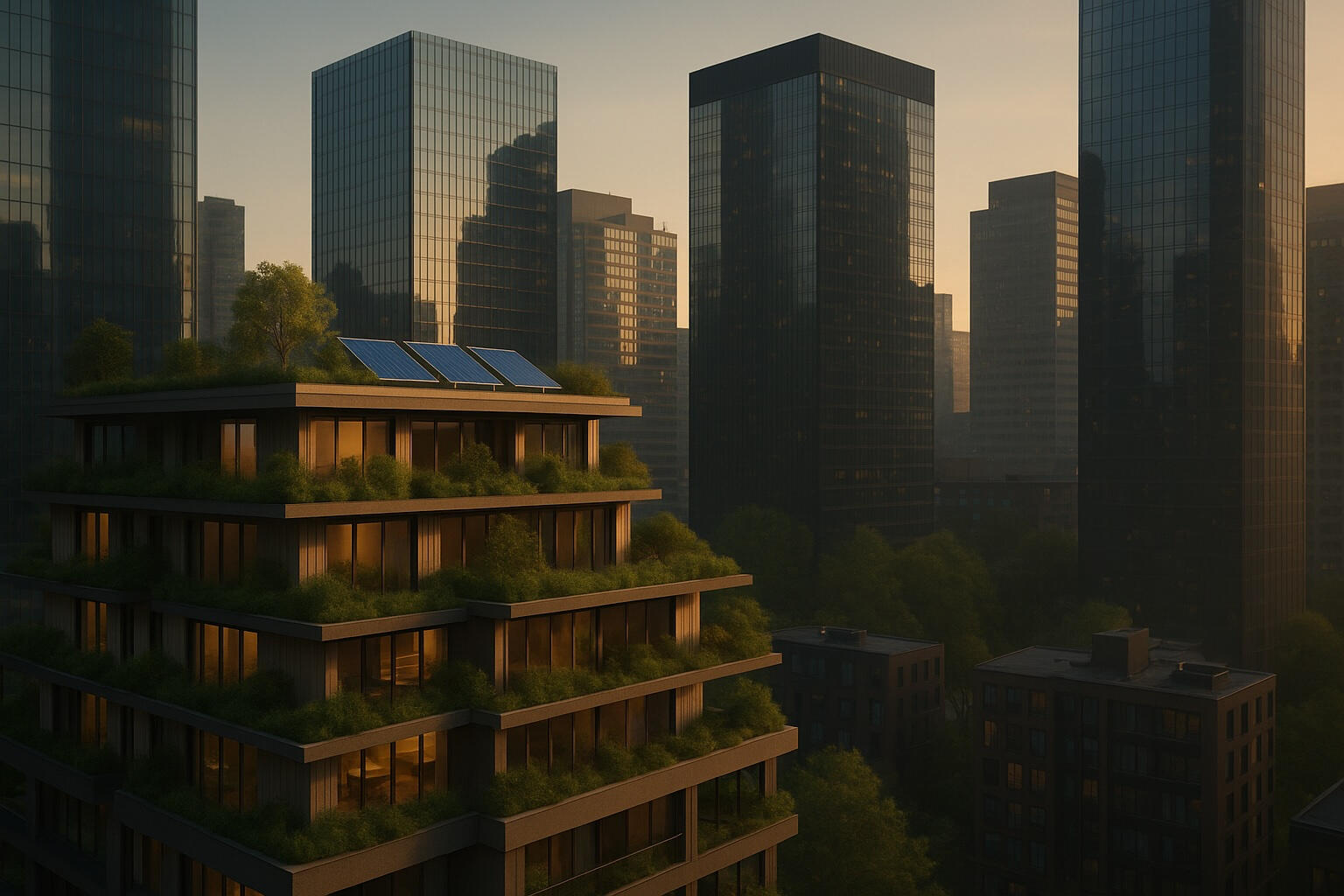

San Siro Verde | Milan, Italy

High-Impact Urban Residential Regeneration

The Opportunity

A 30,000 sqm urban regeneration scheme in Milan's green San Siro neighbourhood. The project has a profound social mission, dedicating c.50% of the residential units to affordable housing. It is designed to the highest ESG standards, targeting EPC Class A certification, sourcing 100% of its power from renewable energy, and creating a new 10,000 sqm public park to enhance local biodiversity.

My Role

I was entrusted with executing this deal, from the initial underwriting to managing its strategic evolution. My analysis was instrumental in the decision to pivot from a simple land sale to a full-scale development, unlocking significant value for the fund. I managed the complex re-underwriting, developed the new financial projections for the development scenario, and coordinated with a multi-disciplinary team including external consultants and city officials to advance the project towards construction.

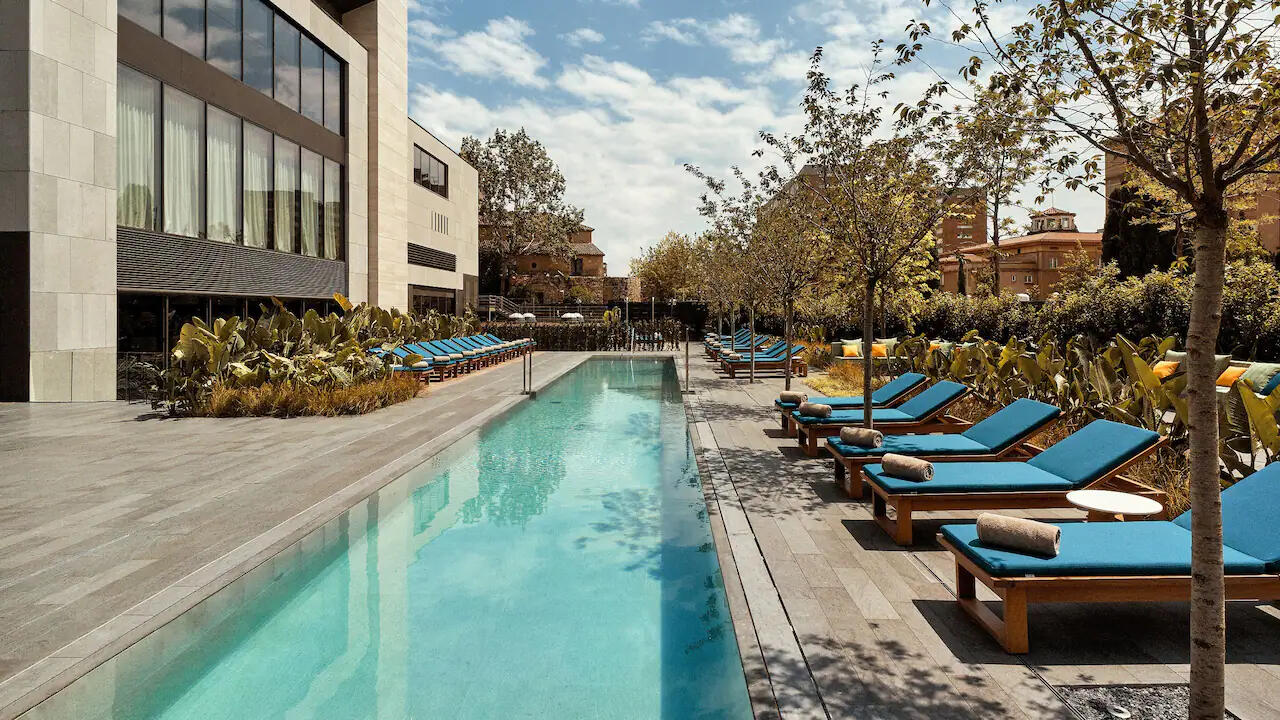

Project Sofia | Grand Hyatt Repositioning

Iconic Hospitality Repositioning

The Opportunity

The acquisition of the 465-room, 5-star Hotel Sofia in Barcelona. The investment thesis was to acquire an iconic but under-managed asset in a market with high barriers to entry due to strict development restrictions. The strategy involved a comprehensive repositioning programme to upgrade the hotel to a market-leading luxury standard, capitalizing on Barcelona's status as a premier global destination for tourism and events.

My Role

As a core member of the Pan-European fund team, I worked with the local Spanish team on the full-cycle execution of this transaction. I was responsible for overseeing the underwriting and stress-testing the financial models prepared locally. My role involved conducting multiple on-site visits, coordinating key due diligence workstreams, and providing critical feedback on the Investment Committee memo to ensure the deal aligned with our fund's value-add strategy. I also played an active part in reviewing the SPA and structuring the joint venture with our local operating partner, Blasson Property Investments.